Gaddis at Textron: From Fruits of Diversification to Financialization

Elliot Yates examines Gaddis’s first corporate writing assignment, with the company Textron, which seems to coincide directly with his first conception of the plot for J R. Textron was one of the first US corporations to explicitly pursue conglomerate “diversification” through buying up seemingly unrelated businesses, and Yates shows how this not only helped generate the plot of J R, but functions as a key to understanding its formal design.

Various materials from the Gaddis Archive by William Gaddis, Copyright © 2024 The Estate of William Gaddis, used by permission of the Wylie Literary Agency (UK) Limited Due to the copyrighted archival material reproduced here, this article is published under a stricter version of open access than the usual Electronic Book Review article: a CC-BY-NC-ND 4.0 license. All reproductions of material published here must be cited; no part of the article or its quoted material may be reproduced for commercial purposes; and the materials may not be repurposed and recombined with other material except in direct academic citation – https://creativecommons.org/licenses/by-nc-nd/4.0/

After the extraordinary artistic ambitions of his 1955 debut The Recognitions reaped less-than-extraordinary financial recompense, a nearly-33-year-old William Gaddis found himself obliged to submit his creative talents to the less capricious mercies of industry. “I have to find warm shelter for 3 and I’m afraid at last a real ‘job’,” he wrote in an October 1955 letter announcing the birth of his daughter to friends John and Pauline Napper—“so, picture me at this point trudging about New York streets like a college boy seeking his first job (it actually is 9 years since I’ve had a real 9 to 5 office world)” (Gaddis, Letters 224–5). Fact-checking for The New Yorker and writing work for UNESCO publications and USIS propaganda magazines preceded the publication of The Recognitions on Gaddis’s resume (Tabbi, Nobody Grew 47, 183; Gaddis, Letters 199–200; Resumé 1962; Retrospective resumé).1 Manhattan’s corporate offices, as he commenced his trudging, were flush with expansionary postwar prosperity. The work he needed, consequently, was not long coming.

Gaddis’s corporate engagements with Pfizer, IBM, Kodak, the Ford Foundation and the US Army, among other organizations close to the heart of the consolidating world hegemon, are now relatively well appreciated factors in the story of the two-decade development of his 1975 magnum opus, J R (Tabbi, Nobody Grew; Chetwynd, “Education-Writing”; “Ford Foundation Fiasco”). In this essay, I will restrict my attention to the hitherto unremarked significance, background and entailments of what was—so far as can be ascertained from the archival material housed at Washington University—his very first post-Recognitions corporate gig. On first glance, this job was, like much of the subsequent corporate work that the novelist would take on, a workaday assignment: writing the script to a short PR film to be screened at the Waldorf Astoria on the occasion of Textron American’s 1956 shareholder meeting. The textile manufacturer, led by its founder, Royal Little, had since 1953 been engaged in some highly unorthodox practices; it fell to Fruits of Diversification, the part-animation, part-documentary reel by Victor Kayfetz Productions2—and fundamentally to Gaddis’s script—to justify them to the satisfaction of its investors. This overlooked film script condenses not only constitutive elements of J R’s conception of American capitalism, but also the germ of the novel’s radical “conglomerative” formal scheme. Fruits, as I will show, is the point of origin for JR Corp and its rhetoric of the family. Most importantly, Gaddis’s work for Textron, which coincided with and deeply informed the earliest moments of J R’s development, was focussed on a subtle—but essential—turn toward financial abstraction.

1. Mills, missiles, miscellaneous

The business orthodoxy of the mid-‘50s held that a textile manufacturer ought not to get involved in buying up companies in unrelated industries. Textron, doing precisely this, was not going against the grain out of wilful contrariness, but in response to the forces and incentives set up around it. Really, by 1956, Textron could not fairly be regarded as a textile company any longer. In seeking, as the script outlines, to “offset the effects of cyclical trends,” and setting out on their “program of planned diversification through acquisition,” they had become an early example of that miscellaneous-amorphous business type we have come to know as the “conglomerate.” A breathless list of “[s]ome of the wide range of products produced by Textron divisions” in a corporate film trade journal covering Fruits of Diversification’s Waldorf debut efficiently surveys the breadth of the company’s holdings:

[S]hown in the film are: television aerials, textiles, polyethylene bags and sheets, Isomode vibration eliminating pads, cold-flow metal parts, plastic brooms, chain saws and carryable generators, plywood, batting, padding, upholstery filling, saddle girths, a revolutionary new foam plastic, centrifugal pumps, radar equipment, radar chaff dispensers, guided missiles and magnetic controls. (“Textron Meets Its Shareholders” 43)

Instruments to pick up signals, instruments to confuse signals. Elementary materials for construction, materiel for destruction. Gaddis had to show how Textron cohered in its contradictions.

The company had started straightforwardly enough running fibre mills, but opportunity swept it sidelong into what an outgoing Eisenhower would a few years later term the “military-industrial complex.” Having availed itself of tax write-offs to expand productive capacity in their synthetic fibre business during the Korean War, the unwinding of the intensified demand generated by that conflict soon left Textron (along with many other textile manufacturers) with peacetime productive overcapacity and no readily available channel for reinvestment. Recognizing the threat posed by a firm’s exposure to cyclically variable demand for textiles, the corporate charter was amended in 1952 to allow it to “admit companies and business from outside [the] textile industry.” Its capital, helped along by its substantial tax credit (a “loss carryforward” such as J R’s readers endlessly hear about) (J R 204, 470) was liberated from bondage to a single industry and diverted into multiple channels of “expansion through acquisition,” creating what Gaddis’s script calls “Textron American’s growing family of business enterprises”—clearly the inspiration for both the basic expansionary strategy and PR rhetoric of “the J R Family of Companies […] An American family of American com[panies]” (J R 530, 578).

Gaddis first formalised the outlines of J R in an August 1956 self-addressed letter. The letter places the project’s first mention to others in February of that year (Letters 227–8). The draft copy of the Fruits of Diversification script preserved among Gaddis’s papers, lightly annotated with pencil revisions in his own hand, is dated February 16, 1956. The work at Textron was simultaneous, then, with a crucial incipient phase in the development of the novel. Already at this early stage, Gaddis had in mind the “very simple proceedures [sic] needed to assemble extensive financial interests, to build a ‘big business’ in a system of comparative free enterprise employing the numerous (again basically simple) encouragements (as tax benefits &c) which are so prominent in the business world of America today” (228).

It is striking that the model of these procedures should be a conglomerate in the making. What Gaddis was tasked with explaining in Fruits would not commonly go by that name for several more years: John Brooks places the term’s “popular appearance in 1964 or 1965, shortly before conglomerates became the darlings of investors” (153). As for the arrival of the peculiar corporate form it describes, it is possible to be quite precise. Jon Didrichsen, in Harvard’s Business History Review, writes that “[c]onglomerate diversification began about 1953” (209). This date registers the decisive importance of two events: a strengthening of antitrust laws, and the end of the Korean War.

Companies like Litton, ITT and TRW would also become conglomerates in the second half of the ‘50s. Teledyne, Gulf & Western, Boise Cascade and Beatrice Foods, among many others, would follow in the ‘60s. All of these companies—in concert with their investors, their partners in the media, and the PR firms they retained—contributed to raising the generic prestige and reputation of the diversified firm. But in Fruits of Diversification, none of this has been achieved yet—a public-facing rhetoric of conglomeration is being invented. When, for instance, JR proudly reads from the article lauding his preternatural attraction to the “smell of profits and the corporate daring which have characterized the company’s abrupt entry into such diverse areas as pap” (650), the satirical target is a discourse Gaddis himself had a hand in developing.

In 1950, the Celler-Kefauver Act had shored up US federal agencies’ antitrust powers, closing loopholes in the 1914 Clayton Antitrust Act and more effectively restricting the capacity of businesses to engage in horizontal mergers or build vertical integration. To buy out competitors, customers or suppliers became a risky proposition. But as Robert Sobel writes, with Textron clearly in mind, “the FTC could not complain of a loss of competition should a manufacturer of textiles acquire the assets of a chain-saw firm” (195). Expansion through acquisition was effectively regulated into a new (seemingly more incoherent) pattern.

Unrelated diversification’s key appeal may have been its permissibility, but it was also possible, as Fruits exemplifies, to make an affirmative case for it as a business strategy—and, by extension, as a financial investment prospect. Operating in a single product category shackled a company for better or worse to that category’s fortunes, but a business operating across several industries became, in effect, a “portfolio.” (In J R, we should pause here to note, the portfolio is no mere term of art, but the battered black torn-zipper taped-up materialization of JR’s paper empire, its excessive physicality a recurrent index of the substantial world financial abstraction attempts to repress.) Overcapacity in textile mills would not necessarily be accompanied by overcapacity in chainsaw factories, and profits earned in chainsaws might compensate for losses incurred in fibre. This logic, of course, depended on the relative independence of “cyclical trends” between industries, and could not meaningfully counteract the broader business cycle. Indeed, while unrelated diversification found favour in the ‘60s and ‘70s, and rose to dominance such that “[b]y 1980, the triumph of the firm-as-portfolio model seemed complete,” with “growth through diversification” becoming “perhaps the most widely used corporate strategy among large firms” (Davis et al. 547), it ultimately failed to outperform—and in many cases actually underperformed—prevailing economic conditions. As the “long downturn” (Brenner, Boom and Bubble 285) dragged on from the oil crisis years and into its second decade, the conglomerate form would decisively fall from favour, declared “discredited” in the business press and discounted by investors (Davis et al. 547).

In the environment of relatively robust economic growth in the US of the early ‘50s, the war in Korea created its own condensed boom and bust cycle. Especially for companies dependent on military procurement, the “powerful artificial stimulus” applied by the war (Brenner, Economics 53) was a boon sorely missed once it was withdrawn. The Korean War marked a significant peak for post-WWII GDP share for US military expenditure: even as defense contractors continued in aggregate to prosper from cold war spending, the proportion of the economy dedicated to military expenses would never again reach the high water mark of 1950–1953 (Elveren 4). Unrelated diversification allowed for the development of alternative income streams that could be used as a hedge against the prospect of “peace break[ing] out’” and monopsonistic demand waning (Sobel 195). At the end of the war in 1953, the logic of acquisitive growth implicit in Celler-Kefauver was activated by companies responding to declining state expenditure and a phase of slowing growth taking hold in the wider economy. Textron’s path to conglomeration, then, proved quite typical, even if the company took this path earlier than the firms that would become its peers. Gaddis had fallen, by a stroke of luck it is unlikely he fully appreciated at the time, into a project that brought him into direct contact with the incipient phase of a characteristic dynamic of midcentury American capital.

Gaddis could not, in 1956, have apprehended the full significance of the historical transformation in which he was immersed: the contours of epochal change become legible and coherent only in retrospect. J R testifies, however, that by the early ‘70s—as the dusk of the postwar economic boom set in, and as his corporate career drew to a close—the conglomerate form had found a privileged place in Gaddis’s understanding of the character and direction of “free enterprise” in America.

2. Financializing the family

The JR Family’s diverse “portforlio” grows rapidly by “going after” existing businesses (125, 653). JR’s business talent, such as it is, resides in his pristinely witless adherence to “what you do,” the procedural axioms absorbed from his education (169, 466). The constitutive virtue of JR Corp’s “topflight aggressive young management” (440) is its ignorance of and insensitivity to the substantial reality and the human complexity of the concerns it subsumes. This, in brief, is the conceptual core of Gaddis’s critical depiction of financialization: it works by keeping reality in abeyance.

To speak of “financialization” here may appear to be in error, an anachronism. J R is about “the business world of America today”—a long “today,” founded on developments that began in the ‘50s, matured in the ‘60s, and began to be transformed, in parallel with the latter stages of the novel’s composition, by the canonically financializing mutations of the early ‘70s. Ali Chetwynd has argued that J R’s strong critical association with “structural changes” of the ‘70s—the Nixon shock, the first oil crisis, neoliberalisation, financialization—is somewhat undermined by the rich and extensive archival record tracing the novel’s economic thinking and thematic development back at least a decade earlier. The significant inspiration drawn from the Fruits of Diversification script all the way back in the mid-‘50s would seem prima facie to bolster and deepen Chetwynd’s case that the archive “[offer]s us a Gaddis of his time” and makes J R seem “less prophetic” (“Friction Problems” 56–7). I submit, to the contrary, that the book’s fundamental presentational logic—serial accumulation, itself in a sense drawn out of the Fruits script—allows J R to incorporate historical events, tendencies, tensions and contradictions from throughout its “long gestation” alongside concerns almost contemporary with its publication, as well as Gaddis’s informed anticipations of future trends.3 It is a book concerned above all with the rising influence not simply of finance per se, but of the “financial picture,” capital’s hyper-abstractive (re)conception of reality as an indifferent system of resources to be infinitely commandeered into an empty process of numerical maximisation. Gaddis represented himself in interviews as a eulogist-defender of the “great system of private capitalism” (LeClair 23) as proliferating “abuses” marred and perverted that system’s functionality (Abádi-Nagy 68–9). J R’s depiction of the system, however, is extraordinarily radical and unapologetic. In its formalisation of the system’s operations, it is far more thoroughgoing and incisive—and, consequently, perennially current—than Gaddis’s explicitly stated personal views would seem to allow.4 As the field of material, structural, institutional and ideological forces that would give rise to financialization proper were still assembling themselves, Gaddis’s novel uncovered the seeds of the financial picture corrosively germinating amidst American capitalism’s ostensible golden age. The conglomerate form, when one pays close attention to its inner logic, directs one’s attention away from the qualitative domain and toward the immanent point of view of capital itself.

The Textron script points out that “the diversified resources brought together in merger would have taken a generation to build up.” The businesses acquired have their own histories and contexts, but in becoming part of Textron are cast in the new light of a higher-order point of view. Fruits is fundamentally concerned with producing, conveying and valorizing this abstract perspective. It seeks to allay the anticipated concerns of shareholders that the structure and strategy of conglomeration might amount to imprudent and incoherent speculation. In showing “just what a share in the Textron family of business enterprises represents today,” it depicts some particular products, but it stresses the minimisation of risk and the company’s developing capacity to “respond alertly and advantageously to changing market conditions.”

The script tours through the new acquisitions: Robbins Mills, American Woolen Company and Textron had merged in 1954; domestic tool maker Homelite, mining and heavy industry company CWC, plastics manufacturer Kordite, military and industrial technology suppliers MB, Dalmo Victor and Ryan Industries, metal hardware company Camcar, vehicle upholsterer Burkart and plywood manufacturer Coquille were acquired over the next year. J R’s roster of companies—largely distributed between JR Corp and the somewhat hazily associated grouping around Typhon and Pythian—contains fictional analogues for many of these: Eagle Mills in textiles, Endo in home appliances, Typhon, Alsaka, Alberta & Western and Ace Development in mining and extraction, Ray-X and Frigicom in military technology, Diamond in electrical cable, Triangle and Duncan in paper. In both the fictional and real conglomerates, the actual commodities produced and the qualitative features of the companies assembled are de-prioritised. The logic of conglomeration turns the attention of the “parent” toward a deracinated, purely calculative cohesion. As the script quite clearly puts it: “Above all, it is th[e] quality of growth which Textron wants its members to continue.” The M–C–M’ cycle at the heart of traditional industrialism, in which “C” opens onto a complex world of production and materiality (Marx 251), begins to lean toward the M–[C]–M’ of financialized indifference.5 The point of view of industrial production inevitably focusses on the plant, the fixed capital, the material inputs, the workforce that animates it. The financialized point of view holds all of this at a distance. In a conglomerate, the “resources brought together in merger” are not to be regarded individually, but as units contingently serving functions within a superior whole. The “parent” is apt to cast off an underperforming “child,” as Textron would eventually do to the textile division that originally constituted its entire business.

This immediately gives rise to the problem of qualitative identity inherent in the conglomerate structure, to which corresponds the imaginary “solution” of brand identity. From Gaddis’s script’s advocacy for the legitimacy and advantages of the conglomerate form, one can readily derive the contours of the anxiety that motivated Textron to commission it:

(i) The diversified conglomerate is characterised by qualitative diversity. It is bound to no particular industry or product.

(ii) Industrial capitalism tended traditionally to identify, sort and understand companies qualitatively, by means of their product(s) or industry. Their quantitative performance in terms of profitability, investment, employment, productivity, etc. could be evaluated individually in relation to companies in the same industry; the relative performance of coherent industrial groupings could be evaluated collectively. Textron was, before the diversification program, a company in the textile industry, a textiles company. The companies JR Corp acquires likewise originate in discrete industries.

(iii) The diversified conglomerate thus faces a problem of identity and coherence. Without recourse to a single industry, small grouping of related industries, or a main product line, the conglomerate’s identity necessarily falls back onto the essentially quantitative considerations of the financial picture: the capacity of the constitutive sub-companies to—aggregatively—generate reliable profits. This rationale cannot but appear “suspect,” as Gerald Davis remarks: “why [does] one need a costly corporate office to oversee the business units that [are] doing the real work? […] Hierarchical levels above the ‘portfolio’ of divisions [are], in some sense, pure overhead” (Davis 77/81). From the standpoint of the investor, it is more difficult to project and analyse the conglomerate’s fortunes, since the proportions of its investment in and exposure to particular sectors, the allocation of its revenue streams and its conquest of a plurality of markets is more complex than in a single-industry company.

(iv) The deterritorialized—abstract, quantitative—identity of the conglomerate is reterritorialized in the ideological, imagistic form of the brand. Gaddis’s Fruits script—and JR Corp in turn—deploys the ideological overlay of the “family,” which, as Ralph Clare argues apropos the fictional conglomerate, “projects a nostalgic and comforting image,” “not only present[ing] a warm and friendly façade to a confused and frightened public but also to an increasingly guarded and suspicious business world” (112–3). The psycho-technical interventions of PR operatives (including corporate writers like Gaddis), marketers, brand strategists and media representations grow in relative importance as the value of capitalist firms becomes increasingly dependent on speculative and “fictitious” factors.

The abstract character of the conglomerate and “unrelated diversification” does not entail a simply “random” selection of companies or industries. In both Textron and JR Corp, a complex web of interests ties private enterprises to each other, to the state, to the military and to politics. Although Textron initially diversified because of a problematic variability of military demand, military hardware would remain an integral part of its business. Military expenditure, not being directly subject to the general business cycle, helps insulate the conglomerate against civilian consumption downturns. And as Baran and Sweezy argued in the mid-‘60s, “the military plays the role of an ideal customer for private business, spending billions of dollars annually on terms that are most favourable to the sellers” (207). Textron’s most successful acquisition would be its 1960 purchase of Bell Aerospace, which would soon supply thousands of UH-1 helicopters to US and Australian forces in Vietnam. Textron continues today to make nearly 30% of its revenue in the defence industry, and, in an uncanny echo of J R, was until its recent closure involved in operating a dysfunctional Rhode Island charter school (Chiacchia). In J R, revolving doors between political office, senior corporate positions and the military see corporations recruiting “brokendown” and “second hand General[s]” or “used admiral[s]” to advance their interests (96, 216, 223, 562, 698), executives heading to Washington (107), corporate lobbyists dictating public policy (543), corporate heads bearing titles of public office (90), politicians securing favourable military policy for industry (97), government creating lucrative contracts for private companies (543)—even JR after his empire collapses plans on tapping into a “groundswill” of support and “entering public life” (726). A particularly brutal military-industrial subplot concerns the lightly fictionalised machinations of intertwined US political and business interests in resource-rich “Gandia” (Congo), the isolation of President Nowunda (Patrice Lamumba) during a crisis of the secession of his country’s most minerally replete province precipitated by his defence minister Doctor Dé (Joseph-Désiré Mobutu), and the collateral damage so easily accepted by US interests—through whose exclusive perspective fragments of the situation are reported—in securing the resources of the periphery for themselves. In this regard, especially when read in the context of the Textron script, JR Corp and the network in which it is embedded appears as a shambling, sickly parody of the midcentury conglomerate, the military-industrial complex and the imperial entwinements of the US state, rather than as an expressly “financial” formation. But this is one moment in the novel’s dynamic, serial-accumulative structure. A closer examination of the formal strategies the novel took up in the wake of Fruits of Diversification will suggest how the layered persistence of distinctly mid-century material can be reconciled with a conception of J R as the first great systems novel of the financial age.

3. “what holds them all together?”

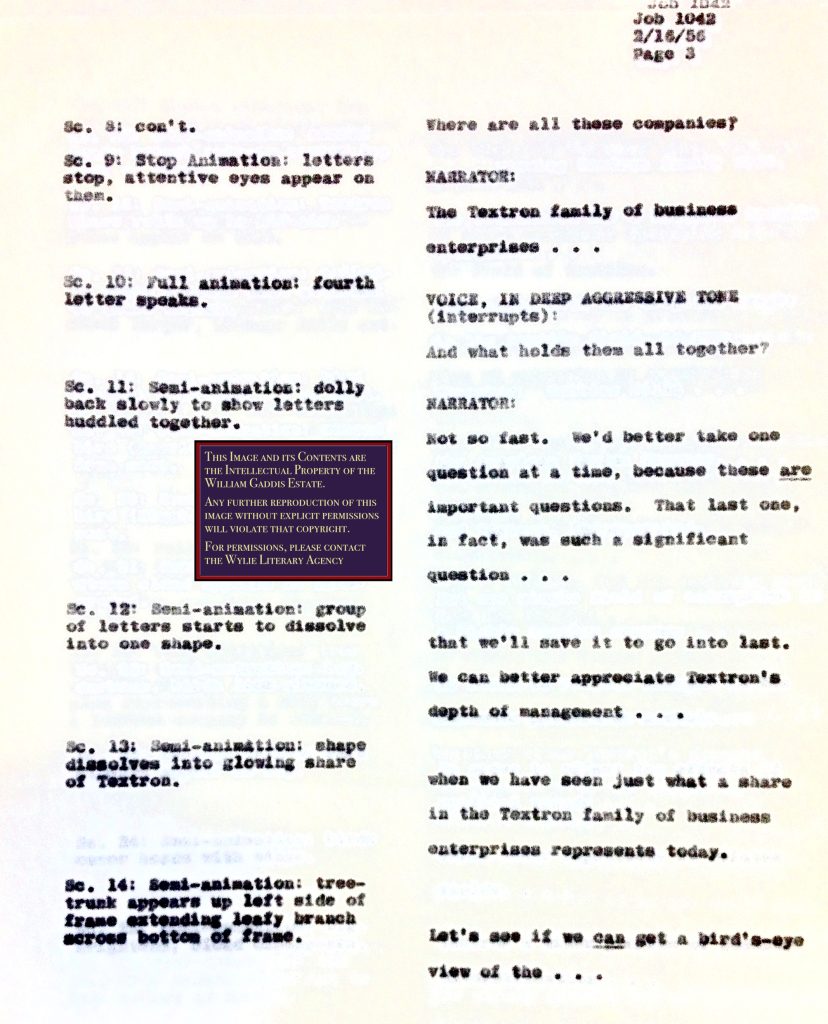

The Fruits script, like several of the later corporate documents that Chetwynd has discussed in his recent triptych of papers, helps to exemplify the truth of Joseph Tabbi’s surmise—from 1989, long before archival evidence would bear it out—that “Gaddis’ corporate experience provided a technical training of sorts for J R” (669). Fruits, like Gaddis’s later corporate film work, separates visual instructions into a lefthand column, audible narration and dialogue to the right (see Figure 1).

The typographical continuity of spoken sentences is continually broken by the points at which visual changes are described, indicated by ellipses and line-breaks. While the narration itself is mostly intended to be spoken continuously, the overall visual impression for the script reader is of broken sentence-fragments and an alternation between two heterogenous orders of discourse. While none of the formal appurtenances particular to scriptwriting are preserved in J R’s final form, the firm division between “dialogic stuff” and “descriptive inserts” noted by Marc Chénetier (253–4) is already clearly formalised in the two-column script format. It furthermore seems that breaking the voiceover narration with ellipses to keep it vertically “synchronised” with the visual description in Fruits suggested to Gaddis the kind of verbal interruption he’d previously written into The Recognitions: a “VOICE, IN A DEEP AGGRESSIVE TONE,” representing a shareholder’s question about Textron’s spate of company acquisitions, interrupts the narrator’s answer to another shareholder voice’s (THIRD VOICE’s) question to demand “And what holds [Textron’s disparate companies] all together?” From Fruits, and from his writing for film through the ‘60s, Gaddis adapted the separation of a physical-descriptive series from a speech series, the former precise and compressed, the latter fractured into ellipsis-terminated fragments and given to interruptive polyphony, each series semi-autonomous with respect to the other, yet fundamentally intertwined.

It is not just the scriptwriting form exemplified by Fruits that J R draws upon, but the very concept of the diversified conglomerate—and not simply at the level of manifest content, but in the book’s deeper formal-organisational structure. The AGGRESSIVE voice’s question about what holds Textron’s companies together is equally “significant” when transposed to consider the coherence of the many heterogenous and historically spread-out strands and elements of J R’s composition. But whereas the narrator of Fruits immediately, reassuringly insists on addressing its shareholder-voices’ concerns “one question at a time,” the question of J R’s cohesion is only ever addressed askance. Conceiving J R as itself something of a textual “diversified conglomerate,” this problem can be stated in terms analogous to the problem of the identity of the conglomerate form outlined above:

(i) The subject matter comprised in J R’s vast thematic scope is highly qualitatively diverse. The desire to “get everything in” makes J R a book “about” business, capital, law, education, politics, ideology, technology, media, communication and its discontents, order and chaos, childhood and parenthood, artistic creation in the modern world, corporate culture, public relations, financial abstraction, US imperialism and the military-industrial complex, racism, lovelessness, belatedness, failure, environmental destruction, and so on. The unusually extensive period of composition and Gaddis’s compulsive artistic orientation towards totality presses its thematic diversity beyond the (already capacious) scope typical of the novel form.

(ii) The novelistic tradition has tended to contain its qualitative diversity through focus on an individual life (or a tightly limited plurality thereof); J R’s thematic range—and its stress on systemic and supra-individual forces—makes this containment highly problematic. J R’s deepest concerns are staged beyond and between its characters. Neither through the book’s eponym, nor its other major characters (Jack Gibbs, Amy Joubert, Edward Bast), nor in all of these in aggregate can its thematic range be adequately focussed. Only through the supplement of its full multiplicity of characters and institutions and its fragmentary allusions to real historical events is its model of totality expressed. It is thus a novel lacking a positive qualitative centre; its core is rather the financial picture and its matrix of “negative considerations” (J R 525).

(iii) J R thus faces a problem of identity and coherence. Without recourse to the conventional coherence of genre, the experiential unification conferred by focalisation through individual experience or consciousness, the thematic coherence of a single overriding problematic, the narrative coherence of a readily understood causal plot sequence or the analogical coherence of a strict intertextual correspondence, J R’s identity falls back fundamentally onto the regularity and unity of its formal construction.

(iv) J R*’s formal unity does not in itself amount to synthetic coherence—the reader’s participation creates the network of connections left latent in the text.* While this is in a sense trivially true for any and all art, J R imposes an aggravated requirement for participatory completion of its structure*.* As Angela Allan remarks, the novel “demonstrates the very problem of its textual economy: authorial intentions are not always made clear to readers, and readers are not always the best interpreters of those intentions” (224), and as Rachele Dini comments, “the absurd mixing of partial dialogues, without some effort on the reader’s part, amounts to little more than gibberish, revealing the ease with which the narrative itself can be reduced to meaningless words” (132). Whether, according to the old Jamesian opposition, J R appears beset with—perhaps overcome by—“queer elements of the accidental and the arbitrary” or contrarily united by “deep-breathing economy” and “complete pictorial fusion” (84–5) is contingent on the vagaries of readerly synthesis. The quality of attention and connective effort made by the reader determines the novel’s value. As Jack Gibbs claims of his own book-within-the-book: “[P]ay attention here bring something to it take something away” (289). J R’s form thus contains a speculative dimension—its true being only crystallizing under the pressure supplied by the labour of reading.

4. Serial accumulation: the money series

By way of conclusion, I would like to offer a close reading from J R that demonstrates—speculatively, perhaps tendentiously—Gaddis’s employment of the serial-accumulative structure to enfold the late-breaking economic developments of the ‘70s into the fundamental texture of the book, incorporating contemporary concerns into the conglomerative plan laid out in the ‘50s.

The ur-series of J R’s serial-accumulative system—the series with which each other major and minor constitutive series becomes intimately interconnected—is spun out from the first word. The “money” series quickly escalates in complexity, ascending from the apparent self-sufficiency of the specie coin to the sublime abstract interconnections of the rising post-Bretton Woods global financial order.6

On the first page, the Bast sisters’ memory of their first encounter with paper notes immediately registers an unease around money’s embodiment of value:

—You couldn’t believe it was worth a thing.

—Not after Father jingling his change. —Those were silver dollars. —And silver halves, yes and quarters. (3)

Thirty pages later, as Bast leads the school Rhinegold rehearsal, these anxieties re-emerge in a symbolically polyvalent re-articulation:

—So where’s the Rhinegold?

—We’re pretending it’s on the table there, you’re all swimming around…

—No like she means we can pretend we’re out here swimming like around this old table which we can even pretend it’s this big rock but there’s nothing on it, like there’s nothing which we can pretend it’s this here Rhinegold.

Again he tapped the baton against the music stand. —The art department has promised the real Rhinegold for Friday, so today you’ll just have to pretend. Pretend it’s there shimmering and glittering, you’re swimming around protecting it, but you don’t dream it’s in danger. (32)

The child-Rhinemaidens are perturbed, we might say, by an inconsistency in the “ontological topography” of the rehearsal’s fiction. The rehearsal’s world is referential: children as characters, the table as the rock, the synagogue rehearsal space as the Rhine waters. The lack of a mundane object to stand in for the Rhinegold troublingly demands the introduction of a supplementary fictional-imaginary layer: the Rhinegold, representationally unmoored, appears precisely as a “shimmering” nothing, present in the rehearsal as a disturbing absence. In an attempt to stabilise the fiction, one of the Rhinemaidens substitutes a bag of real American currency—the $24.63 fated to become Class 6J’s “share in America”—into the empty place of the Rhinegold: “—Hey, see? Here?”, the girl explains, “Like for the Rhinegold, with real money so we can really pretend, see?” (36) While almost any object whatever might have been seamlessly substituted into the place of the Rhinegold, the Rhinemaiden has chosen the most problematic possible object to fulfil this role.

The precise narrative present of J R, as we can reconstruct from real historical references scattered throughout the text (the 1973 Arab-Israeli war, the ensuing oil crisis, the Emergency Petroleum Allocation Act; the Eisen ruling, the stock market crash of 1974), is the autumn and winter of 1974 (403, 540, 683, 702). In this moment, the American dollar had just undergone a quite radical metamorphosis. The Nixon shock had cancelled the convertibility of the dollar to gold in 1971—convergent pressures of money printing to serve Vietnam War and Great Society spending, intensifying German and Japanese competition, a growing balance of payments deficit and European demands to redeem substantial dollar holdings for gold having brought this key element of the Bretton Woods system to an inevitable end, international political economy was placed on the new footing of the “pure” fiat dollar (Mandel 19–20; Fouskas and Gökay 65–6; Brenner, Economics 121–9; Strange). Just as significantly, the 1973 oil crisis had given rise to the petrodollar system. The OPEC price hike saw a large surplus flow of US currency to the Persian Gulf states; these “petrodollars,” invested by oil-exporters in the Global North banking system, created what Roberto Ortiz calls “the zero-point of contemporary financialization” (227–8). Petrodollar recycling, supplying “great lakes of rentier capital” granted American and European banks “a new centrality in world economic trends” (Gowan 158). Petrodollars became private credit, much of which flooded into newly industrializing nations of the Global South (Spiro 164–72; Arrighi 321–4; Lipietz 140–5). “The increased opportunities, greater risks and […] intensified competition that flowed from this privatization of credit” spurred, as Leo Panitch and Sam Gindin write, “dramatic innovations in finance, especially the magnification of the range of securities” (28). This expansion of finance’s scope, technical capacities, power and influence—decisively breaking free from the capital controls and other limitations that the Bretton Woods system had attempted to impose—was intertwined with a new consolidation of American global hegemony and economic dominance. Under “military pressure if not open threat,” as David Harvey puts it, Saudi Arabia had agreed to price its oil exclusively in dollars and (secretly) purchase massive volumes of US Treasury securities (Harvey 27; Wong; Bowcott). In return, the US provided arms and protection. The agreement shored up demand for the dollar as an international reserve and payment currency, stabilised oil supply, and, as Vassilis Fouskas and Bülent Gökay argue, “implicitly created a global petrodollar economic system that not only put a floor under the value of the US dollar, but also allowed the United States to once again manage international trade on terms that disadvantaged its European and Japanese competitors.” This system allowed the US “to print dollars to pay for its oil imports without giving up goods and services in exchange, as the value of those dollars was supported by the demand created for them by the petrodollar/weapon-dollar regime” (72–3). But the regime of floating exchange rates and petrodollars replacing the fixed-exchange, gold-pegged Bretton Woods system led, as Giovanni Arrighi points out, not to a “containment,” but rather “an acceleration of the tendency of the governments of the most powerful capitalist states to lose control over the production and regulation of world money” and consequently to the “accelerating inflation and growing monetary disorder” that characterised the 1970s (323).

Wagner’s Rhinemaidens value the Rhinegold “in an entirely uncommercial way, for its bodily beauty and splendor” (Shaw 9). By contrast, the base metal US currency put in place by (and soon purloined from) Gaddis’s Rhinemaidens (by JR, playing Alberich) is no longer “backed” by promissory relation to the putatively self-evident value of solid, glittering gold. Rather, it derives its social consistency and efficacy from complexly articulated networks of reciprocal flows—the black ooze of oil, the trade of military hardware, extraterritorial capital exports, T-Bills, sovereign wealth fund investments, third world debt—all subtended by the potency of military force. The “real” article to ground, authenticate and validate this network of flows will never arrive; nor can it even be specified. Davidoff’s reference to the Federal Reserve’s subterranean bullion vaults during Class 6J’s Wall Street excursion might intimate the existence of such an object, but much like the school’s stated relation to its students, the Fed’s real relation to the gold—owned mostly by other nations’ reserve banks—is “strictly custodial” (82, 226).

By putting contemporary US fiat dollars in the Rhinegold’s place, Gaddis quietly underscores the extent to which “just hav[ing] to pretend” underlies and actualises all monetary relations. Practical, tacit consent to the socially constituted phantasm of money as “the commodity whose natural form is also the directly social form of realisation of human labour in the abstract” (Marx 241) may be psychologically eased by referential currency’s precious metal “backing” or by specie coin’s direct physical incorporation of the same, but fiat money reveals and amplifies the fetish operative in both of these apparently more “real” forms. In J R, as in the broader post-‘71 world, the money form reveals its fundamental character. Simultaneously “demystified” and explicitly “fictional,” fiat money is a social force constituted—collectively posited—through “really pretend[ing].” The homely-familiar jingle of Father’s change appears from this perspective as an obfuscatory domestication and reterritorialization of the alienation inherent in the money form. The anxiety expressed by the Bast sisters about paper money does not mark a prelapsarian standard from which the contemporary fiat-finance system deviates. The latter’s complex of flows and forces merely supplies, at a higher stage of development, the essentially abstract truth of money as capital. (Analogously, the diversified conglomerate revealed, at a higher stage of abstraction, the latent indifference of the capitalist firm to the goods it produces.) Far from splitting finance off as an excess or “abuse” of the underlying capitalist system, J R symbolically braids contemporary developments in the foundation of American money with a fiction foundational to America’s “monetisation.”

The $24.63 “share in America” that JR appropriates to form the basis of his empire also subtly incorporates in its amount a pointed reference to the expropriation of America from its indigenous possessors. $24, converted from 60 guilders, is the mythified value of beads with which Dutch colonist Peter Minuit ostensibly “purchased” Manhattan from the Canarsie in 1626 (Francis 411–2; Loewen 115; Knight 107; Wolfe 189). This popular framing of the New Netherland settlement as simply the outcome of a shrewd real estate deal—rather than the incursion of empire and the imposition of an entirely alien concept of ownership—smooths over colonisation to shore up and legitimate modern claims to ownership established through this originary violence. JR’s seed capital will go on—much processed and expanded—to take over a gas pipeline consortium that will attempt to appropriate further land from a Native American group already displaced seventy years earlier by other mineral extractors from their treaty-ratified reservation. As Beaton reassures Cates regarding the matter, “any claims they might have had through any treaty involving that earlier reservation can be proved without validity regarding these lands they now occupy and […] any attempt they might make to obstruct the [pipeline can be shown to be illegitimate]” (430). The legally apposite claims to the land’s use fall rather to JR, whose delegated penny stock merger and acquisition adventures grant him “this lousy bunch of mineral rights and like drilling rights or something on these old Alberta right of ways” (332–3, 344).7 The abstract, liquid proprietorship conferred by money abolishes the ambiguous claims of tradition—no matter how long established or deeply embedded—in favour of rights and title transformed into and transferrable as simple commodities.

“Money” may thus be the central, animating element in J R, but Gaddis’s serial-accumulative method gathers around it a hazy, complex image of the social totality in which it is articulated. Money is no mere thing for the novel, even if for the characters it frequently operates as such. The everyday functionality of money is intertwined with the social and historical determinants that its “equipmental” givenness and functional imprimatur tend to repress and expel: alienated and abstracted labour, primitive accumulation and ongoing accumulation by dispossession, imperialism, force and duress are embedded in the conceptual density of J R’s Rhinegold and spill out in its movement through the text like smudged pages from JR’s overstuffed portfolio. In under forty pages, J R ranges from nineteenth-century anxieties around the greenback, forwards to the fiat US petrodollar order, and backwards to the moment of colonial “monetisation.” To observe even this much, however, relies on what amounts to speculative reconstruction, justifiable only in light of details littered throughout the novel’s remainder. The placement of Class 6J’s bag of capital into the position of the Rhinegold in the rehearsal is thus a rather subtle gambit on Gaddis’s part. Its connection to the problematic of the gold standard (and the gold standard’s replacement by the fiat-petrodollar system), as well as its connection to the colonial expropriation of indigenous land (and the system of legal relations built upon this extralegal primitive accumulation), relies on connective leaps that are by no means obvious, and that cannot be said to be strictly intrinsic to the text.

The form of the conglomerate with which Gaddis began J R, all the way back in 1956, already profoundly problematised the notion of the “strictly intrinsic.” In narrating Textron’s transformation, Gaddis was confronted with a chaotic panoply of heterogenous objects—nylon, plywood, vibration pad, chainsaw, missile; each entailing its own worlds of production and use—contingently united by the calculative abstraction of a newly protean profit-seeking entity. In J R, the same logic reaches out to embrace totality.

J R narrates, in other words, the arrival of a world essentially structured by the financial picture. The movement of money capital is revealed as the key causal driver in J R’s world. This movement, in its unbroken, unresting 726-page surge from “Money…?” to “You listening…?,” passes through networks of petty corruption on Long Island, the machinations of financial players and law firms in New York City, the interests behind extractive industry and its collateral damage in Africa. It sweeps through families in estates, trusts and divorces. It reshapes a school, a funeral home, a brewery, a magazine, paper manufacturers, a pharmaceutical maker, and a dozen other companies. It configures the lives of each of the book’s characters. It cuts down trees, asphalts yards, overstuffs apartments and classrooms, sells off baseball fields. These characters, institutions and events first appear to the reader as disparate, chaotic. Close, strenuous readerly attention reveals an intricate web of functional interconnections: in all of the novel’s exhausting talk, very little proves disconnected from or inconsequential to the development of the plot. But this is a plot that does not cohere in the typically novelistic domain of human life and experience. Love and work, ambition and embitterment, hope and resignation: J R’s human stories, even as they form the emotional core of the reading experience, are ultimately dependent, auxiliary, structurally inessential. The novel’s coherence—like Textron’s after 1953—is rather to be found in the abstract processes of money capital: acquisitions, mergers, capital gains, leasebacks, pyramided debenture issues, tax loss carry-forwards. The textual conglomerate contains a broad qualitative heterogeneity, but money is its central and determinative thread.

Throughout his time in the corporate world, Gaddis might be thought of as “pretending”: he was, from 1956 to 1975, a temporarily inconvenienced novelist, never truly a creature of private enterprise. His scripts and speeches and pamphlets were mere work, not “works.” But he was, much like the children in J R’s Rhinegold rehearsal, “really pretend[ing].” The aims and imperatives of corporate communications governed his actions: he really advocated and propagandized, really massaged images and rationalised actions. He really contributed to justifying the conglomerate to shareholders. He did, per JR’s ardent insistence, “what you do.” But when Gaddis turned from his corporate work back to “pretending,” writing fiction, he remained thoroughly absorbed in the world of business. The economic necessity that stretched the composition of J R over two decades was never extrinsic to the creative process. Economic forces—and the multiplicity of their downstream articulations—came to be dominant in and integral to the thematic development, and even the inner structure, of his greatest work. To “really pretend,” then, meant ultimately to allow capital to overwhelm the novel—to allow it, perhaps for the first time, to determine the structure of a work of art as profoundly and essentially as it had lately come to determine the structure—the concrete totality—of the “real” world.

WORKS CITED

Abádi-Nagy, Zoltán and William Gaddis, “The Art of Fiction CI: William Gaddis.” Paris Review, no. 105, 1987, pp. 55–89.

Allan, Angela. “William Gaddis’s Aesthetic Economy.” Studies in American Fiction, vol. 42, no. 2, 2015, pp. 219–41. https://doi.org/10.1353/saf.2015.0013.

Arrighi, Giovanni. The Long Twentieth Century: Money, Power and the Origins of Our Times. Verso, 2009.

Baran, Paul and Paul Sweezy. Monopoly Capital: An Essay on the American Economic and Social Order. Modern Reader, 1968.

Bowcott, Owen. “UK feared Americans would invade Gulf during 1973 oil crisis.” The Guardian, 1 Jan. 2004, www.theguardian.com/politics/2004/jan/01/uk.past3.

Brenner, Robert. The Economics of Global Turbulence: The Advanced Capitalist Economies From Long Boom to Long Downturn, 1945–2005. Verso, 2006.

———. The Boom and the Bubble: The US in the World Economy. Verso, 2003.

Brooks, John. The Go-Go Years: The Drama and Crashing Finale of Wall Street’s Bullish 60s. Allworth Publishing, 1998.

Chénetier, Marc. “‘Centaur Meditating on a Saddle’: Fabric and Function of the Narrative Voice in William Gaddis’ J R.” symplokē, vol. 14, no. 1/2, 2006, pp. 252–70. http://www.jstor.org/stable/40550724.

Chetwynd, Ali. “Friction Problems: William Gaddis’ Corporate Writing and the Stylistic Origins of J R.” Orbit, vol. 8, no. 1:4, 2020, pp. 1–64. https://doi.org/10.16995/orbit.gaddis.2.

———. “William Gaddis’ Education-Writing and His Fiction: A Fuller Archival History.” Orbit, vol. 8, no. 1:2, 2020, pp. 1–47. https://doi.org/10.16995/orbit.gaddis.1.

———. “William Gaddis’ ‘Ford Foundation Fiasco’ and J R’s Elision of the Teacher’s-Eye View.” Orbit, vol. 8, no. 1:3, 2020, pp. 1–46. https://doi.org/10.16995/orbit.gaddis.3.

Chiacchia, B. “When Charter Schools Meet the Military Industrial Complex.” Current Affairs, 19 Sept. 2020, https://www.currentaffairs.org/2020/09/when-charter-schools-meet-the-military-industrial-complex.

Clare, Ralph. “Family Incorporated: William Gaddis’s J R and the Embodiment of Capitalism.” Studies in the Novel, vol. 45, no. 1, 2013, pp. 102–22. https://www.jstor.org/stable/23406586.

Davis, Gerald F. Managed by the Markets: How Finance Re-Shaped America. Oxford UP, 2009.

Davis, Gerald F., Kristina A. Diekmann and Catherine H. Tinsley, “The Decline and Fall of the Conglomerate Form in the 1980s: The Deinstitutionalization of an Organizational Form.” American Sociological Review, vol. 59, no. 4, 1994, pp. 547–70. https://doi.org/10.2307/2095931.

Didrichsen, Jon. “The Development of Diversified and Conglomerate Firms in the United States, 1920–70.” The Business History Review, vol. 46, no. 2, 1972, pp. 202–19. https://doi.org/10.2307/3113505.

Dini, Rachele. Consumerism, Waste, and Re-Use in Twentieth-Century Fiction: Legacies of the Avant-Garde. Palgrave, 2016.

Elveren, Adem Yavuz. The Economics of Military Spending: A Marxist Perspective. Routledge, 2019.

Fouskas, Vassilis and Bülent Gökay. The Fall of the US Empire: Global Fault-Lines and the Shifting Imperial Order. Pluto, 2012.

Francis, Peter Jr. “The Beads That Did Not Buy Manhattan Island.”, New York History, vol. 78, no. 4, 1997, pp. 411–28. https://www.jstor.org/stable/43460452.

Gaddis, William. The Fruits of Diversification. Typescript. The William Gaddis Papers (MS049), Washington University Libraries, Department of Special Collections, St Louis, Missouri, USA. Box 134, Folder 477.

———. The Letters of William Gaddis. Edited by Steven Moore, Dalkey Archive, 2013.

———. J R. Knopf, 1975.

———. Resumé, 1962. Typescript. The William Gaddis Papers (MS049), Washington University Libraries, Department of Special Collections, St Louis, Missouri, USA. Box 139, Folder 494.

———. Retrospective resumé provided in FOI Request for FBI files, 1990. Typescript. The William Gaddis Papers (MS049), Washington University Libraries, Department of Special Collections, St Louis, Missouri, USA. Box 143, Folder 532.

Gowan, Peter. The Global Gamble: Washington’s Faustian Bid For Global Dominance. Verso, 1999.

Harvey, David. A Brief History of Neoliberalism. Oxford UP, 2005.

James, Henry. The Art of the Novel. Scribner, 1962.

Knight, Christopher. Hints & Guesses: William Gaddis’s Fiction of Longing. U of Wisconsin P, 1997.

LeClair, Tom, “An Interview with William Gaddis, circa 1980.” Paper Empire: William Gaddis and the World System, edited by Joseph Tabbi and Rone Shavers, U of Alabama P, 2007.

Lipietz, Alain. Mirages and Miracles: The Crises of Global Fordism. Verso, 1987.

Loewen, James. Lies My Teacher Told Me: Everything Your American History Textbook Got Wrong. New Press, 1995.

Mandel, Ernest. “The Industrial Cycle in Late Capitalism.” New Left Review I, no. 90, 1975, pp. 3–25. https://newleftreview.org/issues/i90/articles/ernest-mandel-the-industrial-cycle-in-late-capitalism.

Ortiz, Roberto. “Oil-Fueled Accumulation in Late Capitalism: Energy, Uneven Development, and Climate Crisis.” Critical Historical Studies, vol. 7, no. 2, 2020, pp. 206–40. https://doi.org/10.1086/710799.

Marx, Karl. Capital, Volume I. Translated by Ben Fowkes, Penguin, 1976.

Panitch, Leo and Sam Gindin. “Finance and American Empire.” American Empire and the Political Economy of Global Finance, edited by Leo Panitch and Martijn Konings, Palgrave, 2008.

Shaw, George Bernard. The Perfect Wagnerite: A Commentary on the Nibelung’s Ring. Dover, 1967.

Sobel, Robert. The Age of Giant Corporations: A Microeconomic History of American Business, 1914–1992, 3rd ed., Praeger, 1993.

Spiro, Joan Edelman. The Politics of International Economic Relations. 4th ed., Routledge, 1992.

Strange, Susan. “The Dollar Crisis 1971.” International Affairs, vol. 48, no. 2, 1972, pp. 191–216. https://doi.org/10.2307/2613437.

Tabbi, Joseph. “The Compositional Self in William Gaddis’ J R.” Modern Fiction Studies, vol. 35, no. 4, 1989, pp. 655–72. https://doi.org/10.1353/mfs.0.1449.

———. Nobody Grew but the Business: On the Life and Work of William Gaddis. Northwestern UP, 2015.

“Textron Meets its Shareholders: Company’s Diversified Operations Pictured at 1956 Meetings.” Business Screen Magazine, vol. 17, no. 5, 1956, p. 43.

Wolfe, Peter. A Vision of His Own: The Mind and Art of William Gaddis. Fairleigh Dickinson UP, 1997.

Wong, Andrea. “The Untold Story Behind Saudi Arabia’s 41-Year U.S. Debt Secret.” Bloomberg, 31 May 2016, www.bloomberg.com/news/features/2016-05-30/the-untold-story-behind-saudi-arabia-s-41-year-u-s-debt-secret#xj4y7vzkg.](http://www.bloomberg.com/news/features/2016-05-30/the-untold-story-behind-saudi-arabia-s-41-year-u-s-debt-secret#xj4y7vzkg](http://www.bloomberg.com/news/features/2016-05-30/the-untold-story-behind-saudi-arabia-s-41-year-u-s-debt-secret))

Footnotes

-

The pre-Recognitions New Yorker (1945–7) and UNESCO (1949–50) jobs are widely mentioned in Gaddis scholarship. The less seemly work for cold war propaganda magazines in the early ‘50s—well-remunerated and allowing substantial freedom—is, however, arguably more typical of the direction his corporate career would later take than the work for venerable liberal institutions. Indicative propaganda subjects reportedly included “Development of Racing Cars in America” and “Religion in America.” ↩

-

This film has never, to my knowledge, been digitized, nor transferred to any other format. How many copies ever existed, and whether any are preserved today, is unclear. Several films Gaddis scripted for the US Army Pictorial Centre’s Big Picture documentary series, by contrast, are available to view on YouTube. ↩

-

Gaddis’s corporate work allowed him considerable first-hand knowledge of the operations, projections and assumptions at play in some of the world’s largest firms. The archive reveals Gaddis’s access to and involvement in, for instance, Pfizer’s attempts to influence American and European tax policy, avoid regulation and restrictions and consolidate the ongoing role of private, for-profit industry in the provision of basic needs. At IBM, he was privy to the company’s expectations about future developments in computation. The work he did for Kodak explicitly deals with the economic and strategic business consequences of the oil crisis. J R can present a uniquely compelling and enduring picture of American business (including its propaganda, its ideology, its PR and image-management) because it is written by an informed—if begrudging and reluctant—insider. ↩

-

Whether J R’s radical grasp of capitalism’s inner nature escaped Gaddis’s full conscious apprehension is not satisfactorily answered by the archival material I have consulted, nor by the published interviews and biographical scholarship. In one intriguing letter from 1986, responding to Clive Suter’s Master’s thesis on J R, Gaddis wonders whether his previous confidence in “our [capitalist] system as essentially sound” might have been misplaced, and whether, with respect to J R’s fundamental critique of the system, “he builded better than he knew” (Letters 424). It seems likely, in any case, that his publicly maintained critical support for American capitalism allowed him to remain attached to the cultural soft power apparatus of the state, travelling extensively on international United States Information Agency tours. ↩

-

“M” in Marx’s algorithm represents money capital advanced in production, “C” the commodity, “M’” is the money capital realised—including surplus value—in the commodity’s sale at the end of the process. Finance, in contrast to industrial production, constitutes itself at an essential abstract remove from the qualitative, material world of the commodity—hence “[

C].” ↩ -

Between the end of WWII and the Nixon Shock of 1971, the Bretton Woods system centred global trade and monetary exchange on the American dollar, which was pegged to, and redeemable for, gold. Under the system, international exchange rates were fixed, while capital controls and other measures tended to subordinate the financial sector to the productive economy. ↩

-

Broker Mister Wiles and shyster underwriter Walldecker—posing as both a Mister Wall and a Mister Decker—actually conduct the business affairs; JR merely occasions them. ↩

Cite this article

Yates, Elliot. "Gaddis at Textron: From Fruits of Diversification to Financialization" Electronic Book Review, 5 May 2024, https://doi.org/10.7273/ebr-gadcent3-3